In today’s dynamic world , safeguarding against potential risks is more critical than ever. Insurance serves as a vital safety net , providing financial security and peace of mind. However , navigating the complexities of the insurance industry can be daunting. One key idea that often goes misunderstood is ‘insurance appetite’. This article aims to demystify insurance appetite , providing you with a thorough guide to understanding and leveraging it for your benefit.

Understanding Insurance Appetite: A thorough Guide. Insurance is a critical component of risk management , providing financial protection against unforeseen events. However , not all insurance policies are created equal , and understanding the idea of ‘insurance appetite’ is crucial for businesses and individuals alike. This guide will delve into the intricacies of insurance appetite , exploring its meaning , key factors , and how to effectively navigate it to secure optimal coverage.

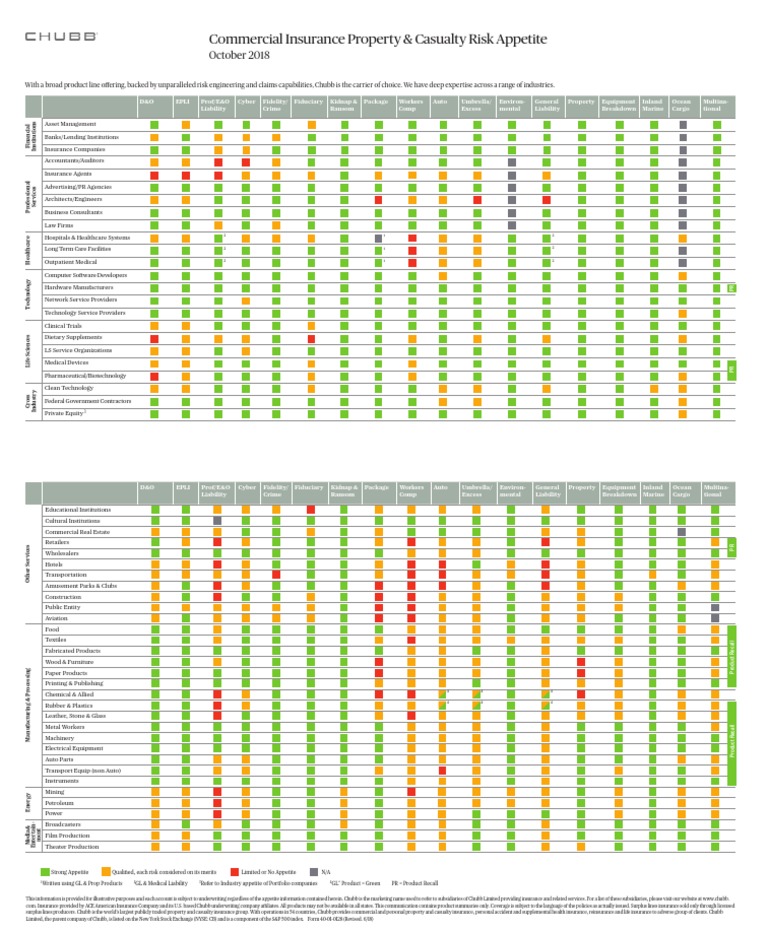

What Exactly is Insurance Appetite ?. At its core , insurance appetite refers to the level and type of risk that an insurance company is willing to accept. Insurers don’t cover every conceivable risk ; they have specific areas of expertise and risk tolerances. This appetite is shaped by various factors , including their financial capacity , underwriting instructions , and overall business plan. Think of it like a restaurant menu ; they specialize in certain dishes and won’t offer everything under the sun. Similarly , insurers focus on specific industries , risk profiles , and coverage types.

Key Factors Influencing Insurance Appetite. Several factors influence an insurer’s appetite for risk. These include: Industry: Insurers often specialize in specific industries , such as construction , healthcare , or technology. Their appetite will be higher for industries they understand well and have a proven track record in. Risk Profile: The inherent risk associated with a particular business or individual plays a significant function. Factors like claims history , safety protocols , and financial stability are all considered. Coverage Type: Insurers may have a stronger appetite for certain types of coverage , such as property insurance or general liability , compared to others like cyber liability or professional indemnity. Geographic Location: The location of a business or individual can also impact insurance appetite. Areas prone to natural disasters or with higher crime rates may be viewed as riskier. Policy Limits and Deductibles: Insurers assess the level of coverage requested and the deductible amount to determine if it aligns with their risk tolerance.

Navigating the Insurance Appetite Landscape: A Practical Guide. Understanding insurance appetite is one thing ; effectively navigating it is another. Here’s a practical guide to help you secure the right coverage: Assess Your Own Risk Profile: Before approaching insurers , thoroughly assess your own risk profile. determine potential risks , evaluate your existing risk management practices , and determine your coverage needs. study Insurers: Don’t settle for the first insurer you find. study varied companies and determine those that specialize in your industry or risk profile. Look for insurers with a strong reputation and a proven track record. Work with a Broker: An insurance broker can be an invaluable asset. They have extensive knowledge of the insurance industry and can help you determine insurers with a strong appetite for your specific needs. Clearly Communicate Your Needs: When approaching insurers , be clear and concise about your coverage needs and risk profile. offer accurate information and be prepared to answer querys. Compare Quotes: Obtain quotes from multiple insurers and carefully compare the terms and conditions. Don’t just focus on price ; consider the coverage limits , deductibles , and exclusions. Build Relationships: Building strong relationships with insurers can be beneficial in the long run. It can lead to better coverage terms , faster claims processing , and a more collaborative approach to risk management.

Related Post : cit bank insured

The Importance of Transparency and Honesty. Transparency and honesty are paramount when dealing with insurers. Concealing information or misrepresenting your risk profile can have serious consequences , including denial of coverage or cancellation of your policy. Be upfront about any potential risks and offer accurate information. This will build trust with your insurer and ensure that you have the right coverage in place.

Navigating the world of insurance appetite can feel like traversing a complex maze. However , armed with this guide , you’re now better equipped to understand and leverage the nuances of insurance appetite. Remember , it’s not just about finding any insurance ; it’s about finding the right insurance that aligns perfectly with your unique risk profile and business objectives. By understanding your own appetite and effectively communicating it to insurers , you can secure optimal coverage , build stronger relationships , and ultimately , protect your assets and future. So , go forth and confidently navigate the insurance landscape , knowing you have the knowledge to make informed decisions and secure the optimal possible outcomes.