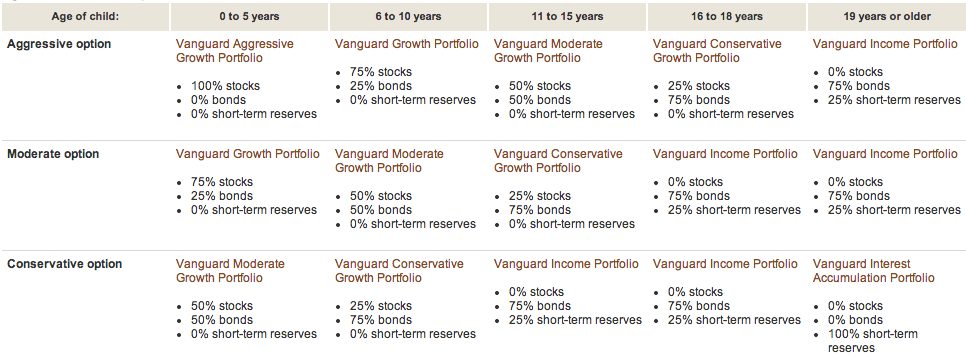

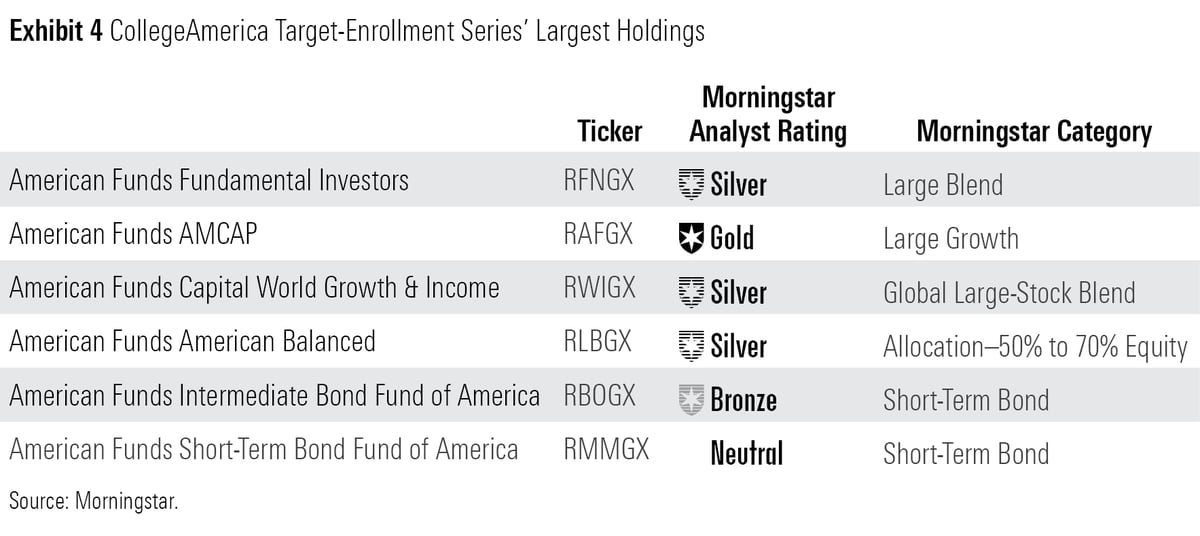

vanguard 529 enrollment application sets the stage for a fantastic opportunity to invest in your child’s education. With the rising costs of college, understanding the ins and outs of a 529 plan is super important for parents who want to save smartly for their kids’ future. This application process can seem daunting, but it’s actually pretty straightforward when you know what to expect.

From navigating the different types of plans to understanding tax benefits, we’ll break down everything you need to know about getting started with a Vanguard 529 enrollment application. Whether you’re a first-time applicant or looking to switch plans, we’ve got the details to help you make informed decisions.

In today’s fast-paced world, finding a balance between work and personal life has become a hot topic for many of us. With the rise of remote work, flexible hours, and the ever-present lure of technology, it can be tricky to carve out time for what truly matters. Let’s dive into the nuances of achieving a work-life balance that doesn’t feel like an impossible task but rather a constantly evolving journey.First off, what does work-life balance even mean?

Well, it’s all about being able to juggle your professional responsibilities with your personal interests and commitments. It’s not just about clocking out at 5 PM; it’s about being present in both your work and personal life, making sure neither aspect gets neglected. This balance is crucial, especially when you consider the effects of stress and burnout. When work takes over your life, it can lead to serious mental and physical health issues, so it’s super important to find a balance that works for you.Now, let’s talk about the common challenges that come with maintaining this balance.

One major hurdle is the blurring of lines between work and home, particularly for those working remotely. When your office is just a few steps away from your living room, it’s easy to feel like you should always be “on.” To counteract this, try setting strict work hours. Just because your laptop is within reach doesn’t mean you need to always be checking your emails or tackling the next big project.

Make it a point to log off at the end of your workday and resist the urge to jump back in. Another challenge is the modern expectation to be perpetually available. With smartphones at our fingertips, it can feel like we’re always on call. A good tip is to set boundaries not only for yourself but to communicate them with others.

Let your colleagues know your availability and stick to it. This creates a culture of respect around each other’s time and helps foster a healthier work environment.But hey, it’s not all doom and gloom! There are plenty of strategies you can implement to help create a better work-life balance. One effective method is prioritization. What tasks are urgent? What can wait?

By identifying what truly needs your attention and what can be delegated or postponed, you free up valuable time for yourself. An easy way to do this is by using a planner or digital tool to keep track of your tasks and set deadlines.Additionally, make sure to carve out “me time” in your schedule. Whether it’s hitting the gym, reading a book, or simply enjoying a cup of coffee in peace, taking time for yourself is essential.

It sounds simple, but it’s often overlooked. Taking breaks throughout the day can recharge your mental batteries and boost your productivity. Incorporate short five to ten-minute breaks into your routine to stretch, breathe, or do something you enjoy.And speaking of breaks, don’t forget about the power of taking a vacation! Even short getaways can provide a much-needed mental reset. If you can’t swing a full vacation, consider a staycation.

Explore your local area, indulge in a favorite pastime, or simply take a day to relax at home without any work interruptions. Another tip is to embrace technology, but with a twist. While tech can be a double-edged sword, it can also facilitate better work-life balance. Use apps that help you stay organized, manage your time, and even remind you when it’s time to disconnect.

Just remember to put down the phone and step away from the screen when it’s time to focus on life outside of work.Don’t underestimate the importance of social connections either. Surrounding yourself with supportive friends and family can help you unwind and recharge. Make it a point to spend quality time with the people who matter most. Whether it’s a weekend brunch, a movie night, or just a casual chat over the phone, these connections can provide a much-needed emotional boost.Lastly, be kind to yourself.

Recognize that achieving work-life balance is an ongoing process. Some days will be more challenging than others, and that’s perfectly okay. Don’t beat yourself up; instead, take a step back, evaluate what’s working and what’s not, and adjust as needed.In conclusion, achieving a healthy work-life balance is both essential and attainable. By setting boundaries, embracing prioritization, and making time for yourself and your loved ones, you can create a more enjoyable and sustainable lifestyle.

Remember, it’s not about perfection; it’s about making small, consistent changes that align with your values and priorities. So, go ahead and take that first step towards a more balanced life. You’ve got this!

FAQ Overview

What is a Vanguard 529 plan?

A Vanguard 529 plan is a tax-advantaged investment account designed to help families save for future education expenses.

How do I open a Vanguard 529 plan?

You can open a Vanguard 529 plan online through their website by completing the enrollment application.

Are there any fees associated with the Vanguard 529 plan?

Yes, like most investment plans, there are fees, including administrative and investment fees, which vary by the plan’s options.

Can I change my investment options after enrolling?

Yes, you can change your investment options annually or if you change beneficiaries, but there are some restrictions.

What happens if my child doesn’t use the funds?

If the funds are not used for qualified education expenses, the earnings may be subject to taxes and penalties unless transferred to another beneficiary.