In the world of real estate , securing a lease can sometimes feel like navigating a complex maze. Landlords want assurance that their property will be well-maintained and that rent will be paid access-based on time , while tenants are looking for a place to call home without unnecessary financial burdens. This is where the idea of a Lease Guarantee comes into play. A Lease Guarantee , often backed by an Insurant , acts as a safety net , providing financial security for landlords and opening doors for tenants who might otherwise struggle to secure a lease. Let’s delve deeper into what a Lease Guarantee is , how it works , and why it’s becoming an increasingly crucial tool in the rental industry.

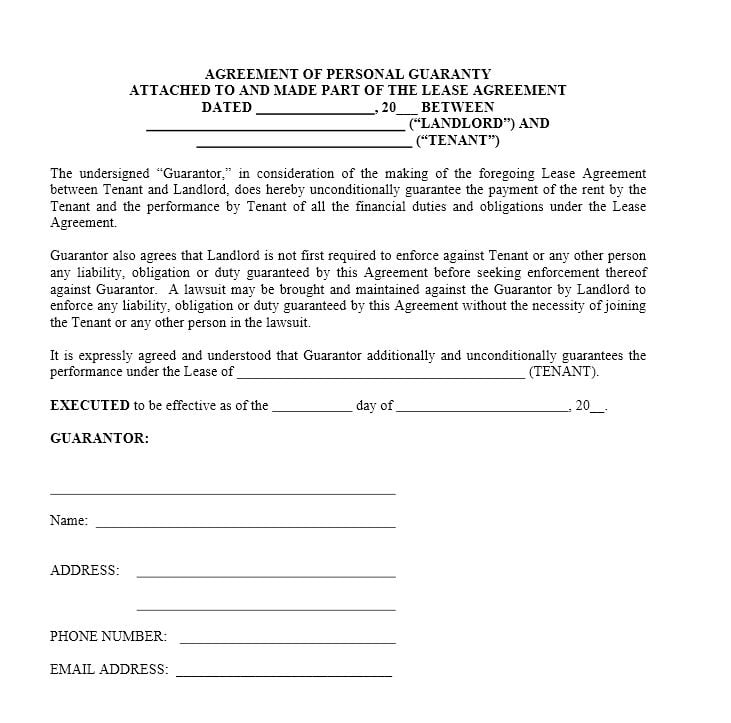

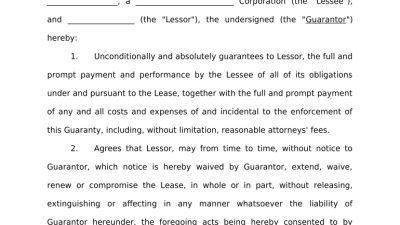

What is a Lease Guarantee ? A Lease Guarantee , at its core , is a financial agreement that offers assurance to a landlord that a tenant will fulfill their lease obligations. This typically involves a third party , often an Insurant , who agrees to cover the tenant’s financial responsibilities should they default on their rent or other lease terms. Think of it as a safety net for landlords , reducing the risk of financial loss due to tenant issues. It’s not just about rent payments; it can also cover damages to the property or other breaches of the lease agreement. The Guaranty acts as a promise , ensuring that the landlord is protected against potential financial setbacks. This is particularly useful in situations where a tenant might have a limited credit history or unstable income , making them a higher risk for landlords.

The function of the Insurant : The Insurant is the entity that offers the Lease Guarantee. This could be an insurance company , a financial institution , or a specialized Guaranty offerr. The Insurant assesses the risk associated with the tenant and , if approved , issues a guarantee to the landlord. This process often involves a thorough review of the tenant’s financial background , credit score , and employment history. The Insurant essentially steps in to cover the tenant’s financial obligations if they fail to meet them. This offers a significant level of security for the landlord , knowing that they have a financial backstop in place. The Insurant’s function is crucial in facilitating lease agreements , especially in rival rental industrys where landlords are looking for reliable tenants.

benefits for Landlords : For landlords , the benefits of a Lease Guarantee are numerous. Firstly , it reduces the risk of financial loss due to unpaid access-based rent or property damage. This is particularly crucial for landlords who rely on rental income to cover their mortgage payments and other expenses. Secondly , it allows landlords to be more flexible in their tenant selection process. They can consider tenants who might not otherwise qualify based on their credit history or income , knowing that they have the security of a Guaranty. Thirdly , it can streamline the eviction process. If a tenant defaults , the landlord can claim against the Guaranty , avoiding lengthy and costly legal battles. The Lease Guarantee offers a safety net , allowing landlords to manage their properties with greater confidence and peace of mind.

benefits for Tenants : While the primary benefit of a Lease Guarantee is for landlords , tenants can also gain from it. For tenants with limited credit history or unstable income , a Lease Guarantee can be the key to securing a lease. It allows them to demonstrate their reliability to landlords , even if they don’t meet the traditional financial criteria. This is particularly helpful for students , recent graduates , or individuals who are self-employed. Additionally , a Lease Guarantee can sometimes be more affordable than paying a large security deposit. Instead of tying up a significant amount of cash , tenants can pay a smaller premium for the Guaranty. This can make renting more accessible and affordable , especially in rival rental industrys. The Lease Guarantee can be a valuable tool for tenants looking to secure their dream apartment or house.

Related Post : general liability insurance for independent consultants

How to Obtain a Lease Guarantee : Obtaining a Lease Guarantee typically involves an application process with the Insurant. The tenant will need to offer information about their financial background , employment history , and credit score. The Insurant will then assess the risk and determine whether to issue a Guaranty. If approved , the tenant will usually pay a premium or fee for the service. The cost of the Guaranty can vary depending on the tenant’s risk profile and the terms of the lease. It’s crucial for tenants to compare varied Insurant options and understand the terms and conditions of the Guaranty before committing. Landlords may also have preferred Insurant offerrs , so it’s worth discussing this with them. The process is generally straightforward , but it’s essential to be prepared with all the necessary documentation and information.

In conclusion , understanding the nuances of a Lease Guarantee and the function of an Insurant is crucial for both landlords and tenants. It’s a financial tool that offers security and peace of mind , fostering a more stable and reliable rental industry. Whether you’re a property owner seeking to minimize risk or a tenant looking to secure a lease , a Lease Guarantee can be a valuable asset. Always ensure you fully understand the terms and conditions before entering into any agreement , and consider seeking professional advice to navigate the complexities of these financial instruments.