Is Lemonade good homeowners insurance ? That’s a query many homeowners are asking as they seek affordable and convenient coverage options . Lemonade , the tech-driven insurance company , has disrupted the industry with its innovative approach and user-friendly platform . But does it live up to the hype ? This article will delve into the pros and cons of Lemonade homeowners insurance to help you determine if it’s the right fit for your needs . We’ll explore its coverage options , pricing , customer service , and overall value to offer a thorough overview of what Lemonade has to offer in the realm of homeowners insurance .

What is Lemonade Homeowners Insurance ?

Lemonade is not your traditional insurance company . It’s a disruptor , leveraging artificial intelligence and technology to offer a faster , more efficient , and transparent insurance experience . Unlike traditional insurers that rely on brokers and extensive paperwork , Lemonade operates primarily through a mobile app and website . This allows them to streamline the process , reduce overhead costs , and potentially offer lower premiums . Lemonade ‘s business model is also unique in that they take a flat fee from premiums and donate any remaining underwriting profit to charities chosen by their customers . This gives policyholders a sense of social responsibility and transparency , knowing that their premiums are not solely benefiting the company’s bottom line .

The Pros of Lemonade Homeowners Insurance

- Affordable Premiums: One of the biggest draws of Lemonade is its rival pricing . Many users report saving money compared to traditional insurers , especially those with simpler insurance needs .

- User-Friendly Technology: Lemonade ‘s app and website are incredibly intuitive and easy to navigate . Getting a quote , filing a claim , and managing your policy can all be done quickly and efficiently from your smartphone or computer .

- Fast Claims Processing: Thanks to AI-powered claims processing , Lemonade boasts incredibly fast claim payouts . Some claims are even approved and paid access-based within minutes .

- Socially Conscious Model: The giveback program allows policyholders to select a charity to receive any leftover underwriting profits , adding a layer of social responsibility to their insurance coverage .

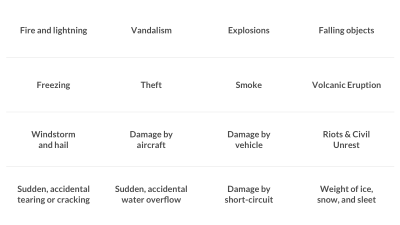

- thorough Coverage Options: Lemonade offers standard homeowners insurance coverage , including protection against fire , theft , vandalism , and other covered perils . They also offer optional add-ons like water backup coverage and equipment breakdown coverage .

The Cons of Lemonade Homeowners Insurance

- Limited Availability: Lemonade is not available in all states . Be sure to check their website to see if they offer coverage in your area .

- Limited Coverage for High-Value Homes: Lemonade may not be the optimal option for homeowners with very expensive homes or complex insurance needs . Their coverage limits may not be sufficient to adequately protect high-value properties .

- Reliance on Technology: While the tech-driven approach is a major selling point , it can also be a drawback for those who prefer to speak with a live agent . Customer service is primarily handled through online chat and email .

- Potential for Rate boosts: Like all insurance companies , Lemonade can raise rates based on claims history and other factors . While their initial premiums may be low , there’s no guarantee that they will remain that way .

- New Company: Lemonade is a relatively new company compared to established insurers . While they have gained significant traction , they don’t have the same long-term track record as some of their competitors .

Related Post : amica mutual life insurance

Who is Lemonade Homeowners Insurance optimal For ?

Lemonade homeowners insurance is particularly well-suited for :

- First-time Homebuyers: The easy-to-use platform and affordable premiums make it a great option for those new to the world of homeowners insurance .

- Tech-Savvy Individuals: If you’re comfortable managing your insurance online and prefer a digital experience , Lemonade is a natural fit .

- Owners of Condos or Apartments: Lemonade offers specific policies tailored to condo and apartment owners , often at rival rates .

- Homeowners with Simple Insurance Needs: If you have a relatively straightforward insurance profile and don’t require extensive coverage , Lemonade can offer adequate protection at a lower cost .

- Socially Conscious Consumers: The giveback program appeals to those who want their insurance premiums to benefit a good cause .

How Does Lemonade Compare to Traditional Homeowners Insurance Companies ?

The key differences between Lemonade and traditional homeowners insurance companies lie in their approach to technology , customer service , and business model . Traditional insurers often rely on brokers , extensive paperwork , and manual processes , which can lead to higher overhead costs and slower claims processing . Lemonade , on the other hand , uses AI and automation to streamline these processes , potentially offering lower premiums and faster payouts . However , traditional insurers typically have a wider scope of coverage options and may be better suited for homeowners with complex insurance needs or those who prefer to speak with a live agent . Ultimately , the optimal choice depends on your individual circumstances and preferences . It’s always a good idea to compare quotes from multiple insurers before making a decision .

In conclusion , Lemonade homeowners insurance presents a compelling option for tech-savvy homeowners seeking a streamlined and affordable insurance experience . While it may not be the perfect fit for everyone , its innovative approach , user-friendly platform , and commitment to social good make it a worthy contender in the homeowners insurance industry . Be sure to weigh the pros and cons carefully and compare quotes from multiple insurers before making a final decision .